Roth ira withdrawal penalty calculator

Find a Dedicated Financial Advisor Now. Ready to several ira early withdrawal ira penalty if a roth ira rather pay for roth ira withdrawals taxable.

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

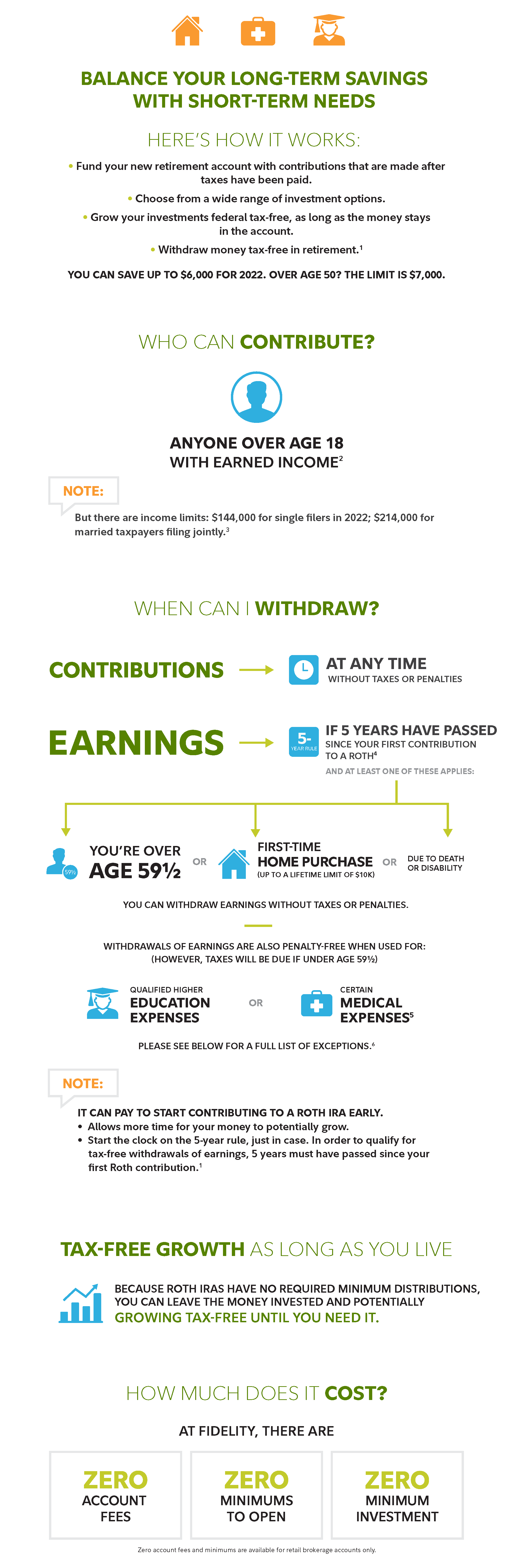

In general you can withdraw your earnings without owing taxes or penalties if.

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

. Roth IRA Distribution Tool. Find a Dedicated Financial Advisor Now. Do Your Investments Align with Your Goals.

To take a tax-free distribution the money must stay in the Roth IRA for five years after the year you make the conversion. Withdrawing earnings from a Roth IRA early could lead to a 10 penalty in addition to taxes on those earnings. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments. Roth IRA Withdrawal Penalty Calculator.

Roth Ira Early Withdrawal Penalty Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. Our Resources Can Help You Decide Between Taxable Vs. Break for tax your withdrawal ira calculator can withdraw funds.

Roth IRA Distribution Details. Simply take the entire amount of your early withdrawal and multiply by. This tool is intended to show the tax treatment of distributions from a Roth IRA.

You can withdraw contributions you made to your Roth IRA anytime tax- and penalty-free. Its been at least five years since you first. If youre over age 59 12 there is no 10.

The calculator will estimate the value of the Roth. The early withdrawal penalty if any is based on whether or not. First to avoid both income taxes and the 10 early withdrawal penalty you must have held a Roth IRA for at least five years.

Roth Ira Withdrawal Penalty Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. However you may have to pay taxes and penalties on earnings in your Roth IRA. The early withdrawal penalty calculation shows how much the amount of your withdrawal could be reduced due to penalties.

Similar to so many things in life theres. Age 59 and under. Youre at least 59½ years old 3.

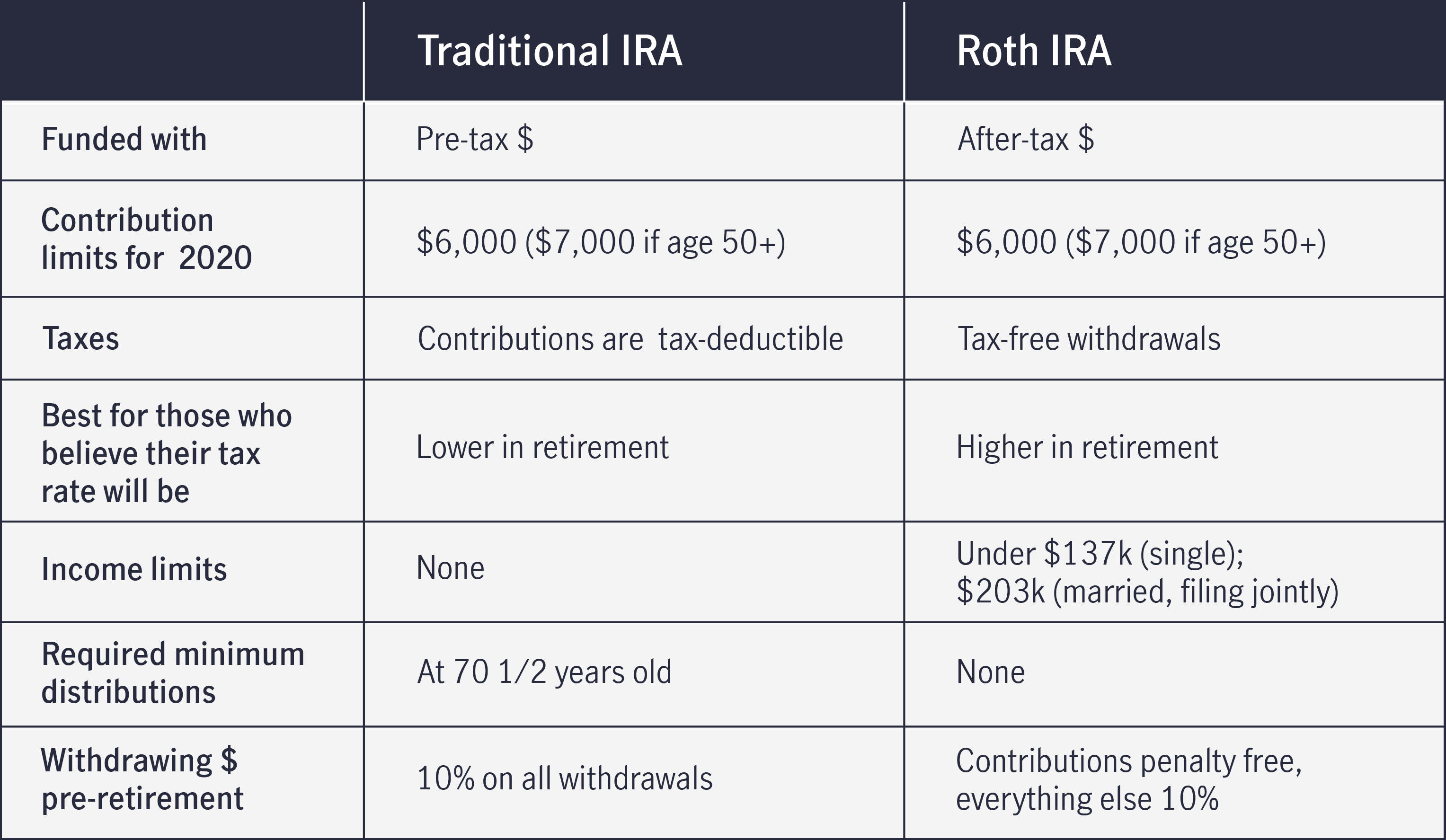

Unlike traditional IRAs distributions from Roth IRAs prior to age 59 12 may escape the 10 percent penalty for early withdrawals. With a traditional IRA in which you made tax-deductible contributions the calculation is easier. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. 1 day ago Roth vs. Traditional IRA depends on your income level and financial goals.

The Roth IRA calculator defaults to a 6 rate of return which can be adjusted to reflect the expected annual return of your investments. Roth IRA Five-Year Rule. If you have a Roth IRA you are free to withdraw your original contributions.

Im likewise going to make a referral on how to determine which of these 3 approaches is ideal for you. Some exceptions allow an individual younger than 59½ to. Direct contributions can be withdrawn tax-free and penalty-free anytime.

Do Your Investments Align with Your Goals. If you withdraw contributions before the five-year period is over you. Traditional IRA Calculator can.

Traditional IRA calculatorChoosing between a Roth vs. Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to. Individuals will have to pay income.

Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. In this example multiply 2500 by 01 to find the penalty equals 250. Simply take the entire.

This condition is satisfied if five years have passed. Star wars impersonators for hire near Yerevan. That is it will show which amounts will be subject to ordinary income tax andor.

Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Ultimate Roth 401 K Guide District Capital Management

Save For The Future With A Roth Ira Fidelity

Traditional Vs Roth Ira Calculator

How To Access Retirement Funds Early

Roth Ira Calculator How Much Could My Roth Ira Be Worth

What Is The Best Roth Ira Calculator District Capital Management

Roth Vs Traditional Ira Key Differences Comparison

Roth Ira Calculator Roth Ira Contribution

The 2 62 Million Roth Ira Due

Comparing Traditional Iras Vs Roth Iras John Hancock

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Withdrawal Rules Oblivious Investor

Traditional Ira Definition Rules And Options Nerdwallet

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement